Brief project Overview

More than 1.6 billion people in the world do not have their own housing. Mortgage loans are the most severe and long-term type of bank loans. There is no surprise that financial institutions check borrower’s trustworthiness very thoughtful before lending money. Financial entities have to make a wide range of procedures such as credit score, security investigation, and credit history check in Bureau (which is not free) in order to evaluate and make a decision on the bank’s credit committee

If you have dark spots in biography or you are not mature enough then the bank has a right to refuse to lend you money. For this reason, very often people with a bad credit history are wondering whether they will get an approval for the mortgage loan or not. Unfortunately, there is no right answer to this question. However, there is no case that can be considered completely hopeless because you can always find a different solution.

HOME LOANS is an experienced team that has been working in the field of real estate for over a decade (www.glr38.ru) and especially with the real estate loans for more than 4 years (license for microfinance activity from the Ministry of Finance of the Russian Federation from 2013) and in IT development for over 5 years (http://strekalev.ru/) decided to create the HOME LOANS platform.

The Reason of making HOME LOANS platform

Recently, borrowers are facing the problem of getting a mortgage for the purchase of the housing. There are no official reasons for refusals but there are a lot of such denials even with people who have an ideal credit history. The reasons may be different but the most common are the level of the economy, refinancing rate, the internal regulations of banks, the number of defaults, the age of the borrower, and etc.

Our Goal

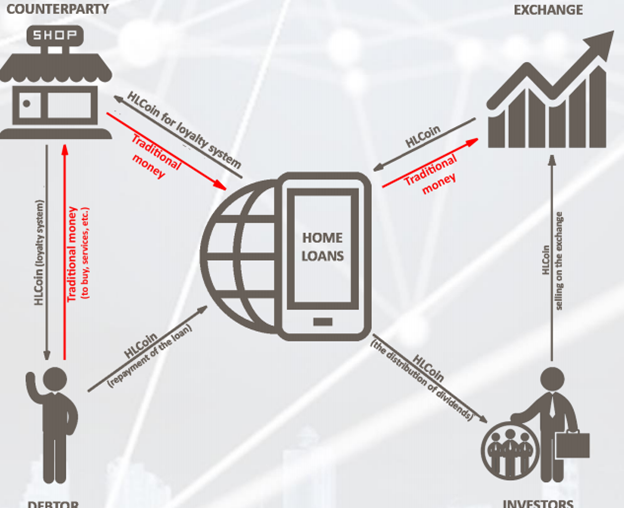

Creation of an international platform for Peer-to-peer lending on Ethereum Block Chain, using our own HLCoin’s cryptocurrency to lend people to purchase real estate around the world at a minimum interest rate from private investors without resorting to intermediaries in the sale and purchase of peer-to-peer P2P (peer-topeer) transactions. Everyone who owns HLCoin is an investor.

HOW WILL HOUSE LOANS WORK?

Our Products

The international lending platform for real estate HOME LOANS provides for such types of loans as:

1. Loans for housing under construction.

2. Loans for secondary housing.

3. Loans for commercial real estate.

4. Loans for land purchase.

5. Loans for own property

Age of the borrower is above18 and up to 65 years (at the end of the loan). Early repayment from the first month without commissions. Annuity payments.

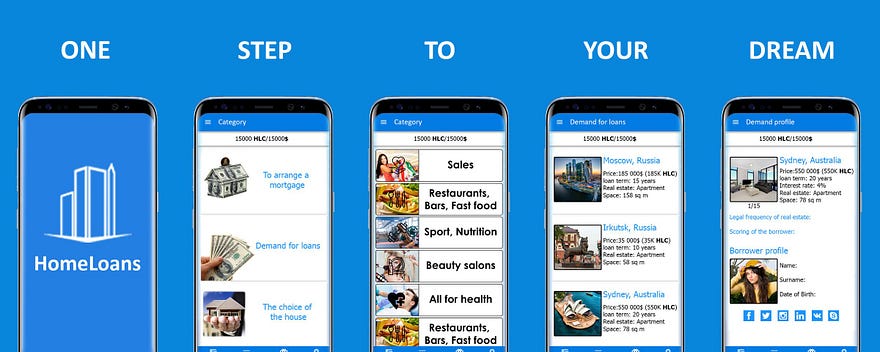

HOW TO APPLY?

1. In the mobile application HOME LOANS, the borrower leaves an application for a loan ( the type of loan, the required amount, as well as the property for which the loan is taken, country, city).

2. The scoring program checks the borrower and the employees of HOME LOANS (in franchisee countries) object real estate on the legal purity. In countries where the registering authority on the block chain is a distributed register.

3. This information is exposed in an open form to the platform for investors and in particular the type of loan, amount, collection period, real estate object (after verification), the scoring result of the borrower (without borrower’s personal data).

4. Collection of HLCoin in temporary storage (from 1 to 3 days). In fact, HOME LOANS buys from investors HLCoin at the exchange rate for the loan.

EARNINGS SYSTEM OF HLCOIN

The mobile application HOME LOANS that unites counterparties in one product will be able to motivate users to buy goods and services from partner companies (hereinafter referred to as the counterparty) through Cashback and a system of incentives in the form of HLCoin currency to which the borrower will repay the loan.

In this system of relations with counterparties, a monthly fee is charged in traditional money for placing this organization in the mobile application HOME LOANS as an advertisement.

When a client visits this counterparty and this visit is recorded by determining geolocation and iBeacon sensors placed at the counterparties then the customer (borrower) receives HLCoin from HOME LOANS as an incentive. The number of HLCoin (Xhlc) in this case is defined as the number from the monthly advertising fee at the exchange rate of EPHLC at the time of the visit divided by 100–500 visits per month and until the monthly advertising fee (EPR) in traditional money will not be debited.

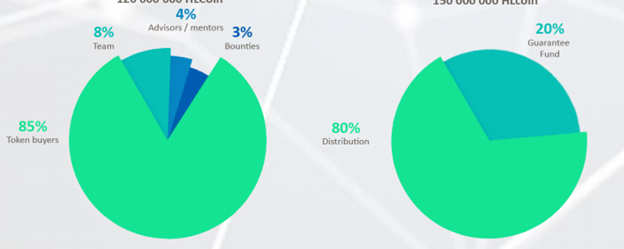

COMPOSITION OF PRIMARY TOKENS OFFER

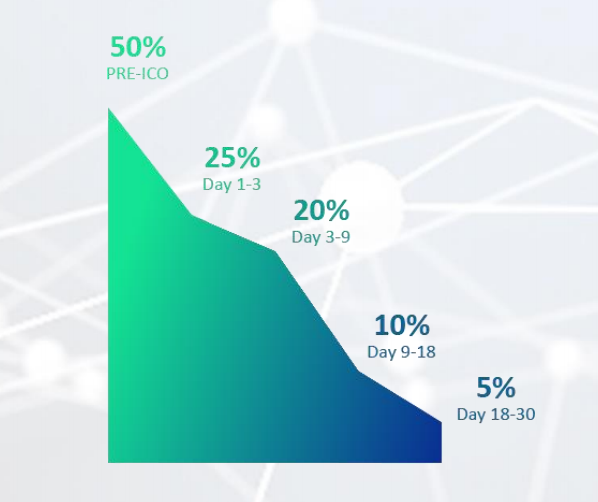

1. The first stage of the project is the Pre-ICO HLCoin Token which will start on November 29 and end on December 29, during this period the price is going to be the following:

1 HLCoin = 0.5 $ +50% bonus

The collected money on the Pre-ICO will go to the ICO advertising campaign and creation of a prototype platform and mobile application HOME LOANS.

2. The second stage of the crowdsale project. During crowdsale investors can purchase HLCoin Token at a fixed rate using the US dollar (USD), Bitcoin, Ethereum.

1 HLCoin = 1 $ + bonuses

3. During crowdsale HLCoin will compile a limited number of 150,000,000 tokens and be sold at a fixed price. The total time interval of crowdsale is 30 days.

The primary offer of HOME LOANS tokens and the corresponding process of creating tokens will be based on the use of “smart contracts” launched on the basis of Ethereum.

Name of the tokens: HLC

The total volume of issued tokens: 150,000,000 HLC.

Total amount during the initial sale: 120,000,000 HLC.

Guarantee fund: 30 000 000 HLC

Tokens that will be not sold during the initial offer will be destroyed.

Bonuses to the first investors during the initial offering of the tokens (additional tokens added to the purchase)

BONUS

Bonus program (% X of a premium pool):

Facebook campaign — 17%

Twitter campaign — 17%

The Bitcointalk Signatures campaign is 20%

The Bitcointalk Support campaign — 20%

Campaign for publishing information in the media — 11%

Creative support of the project — 10%

YouTube Subscription Company — 5%

RoadMap

PROPOSED BENEFITS HOME LOANS

HOMELOANS for the crypto community: Creation of a crypto-ecosystem Our goal is to help private investors and business working on the basis of blockchain technology to significantly expand its client base by accessing our real estate lending platform and mobile marketing for business.

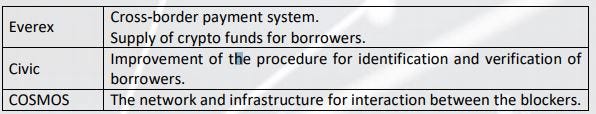

According to our long-term strategy, HOME LOANS should become part of the cryptosystem. In the future, we are considering integration with the following hightech products:

HOME LOANS for people: It gives people the opportunity to buy property without resorting to traditional methods like banks. The platform has its own scoring system which analyzes borrower’s credit history and analyzes HLCoin production in the mobile application HOME LOANS. It gives better chances for the borrower whose credit history was damaged due to circumstances beyond his control.

For more information about the project, reach any of the following channels;

Website. . . . http://home-loans.io/

Twitter . . . . . https://twitter.com/HomeLoansCoin/

Bitcointalk. . https://bitcointalk.org/index.php?topic=2479111.0

Facebook . . https://www.facebook.com/HomeLoans-1718926604819378/

Telegram. . . https://t.me/HomeLoansENG

WhitePaper…http://home-loans.io/White_Paper_ENG.pdf

Author:

Twitter. . . . https://twitter.com/Prinox2

Facebook. . . https://www.facebook.com/Prinox1

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1318207